Solved: Owners Contributions

Contents:

The starting balances for other Balance Sheet accounts that are created in the Add New Account dialogue box. I can’t find anything that seems to address this situation. Research on APIC seems to indicate that distributions don’t reduce APIC but can only be reported against RE. So he can take future distributions in excess of retained earnings against APIC? I thought distributions could not be reported against APIC and could only be reported against RE.

how can you lower an intrest rate for a student loan? -【how to help … – Caravan News

how can you lower an intrest rate for a student loan? -【how to help ….

Posted: Mon, 24 Apr 2023 13:26:02 GMT [source]

Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on „next,“ which shows your file data. To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it.

How to Record Owner Draws Into QuickBooks

In order to register the cash contribution of the owner, you can select from two separate options. You can Create the Bank Deposits or navigate to the Chart of Accounts. The business is currently a single-member LLC, but I want to design the COA to be somewhat flexible for future potential growth. So I’d like to create a sub-account with my name on it rather than just using the generic names. That way it’s easier to see who has what equity amounts. Again, you do not post anything directly to the top-level account, but only to the sub-accounts.

Ask questions, get answers, and join our large community of QuickBooks users. Adrian Grahams began writing professionally in 1989 after training as a newspaper reporter. His work has been published online and in various newspapers, including „The Cornish Times“ and „The Sunday Independent.“ Grahams specializes in technology and communications. He holds a Bachelor of Science, postgraduate diplomas in journalism and website design and is studying for an MBA.

How to Record a Cash Deposit in QuickBooks

Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done. In case you wish to pay or use any fund from the particular general business assets, you can utilize the Owner’s draw account to register any transactions. By separating the information of the owner from the general finances of the company, it makes it convenient to prepare the taxes and monitor income and expenses.

how big is the auto loan business -【business loan using.home … – Caravan News

how big is the auto loan business -【business loan using.home ….

Posted: Mon, 24 Apr 2023 09:59:23 GMT [source]

Select the appropriate equity account from the drop-down list in theAccountfield. Choose the bank account where your money will be withdrawn. Select the appropriate equity account from the drop-down list in the Account field.

Learn how to set up accounts to track money that your partners or owners invest in or draw from a business. From theAccountdrop-down menu, select the bank account you’re depositing the money into. Once done, you can create a check and use the owner’s equity account to record the payment. From the Account▼ drop-down menu, select the bank account you’re depositing the money into. Select „Make Deposits“ from the drop-down menu. If QuickBooks displays the „Payments to Deposit“ window, click to select the payment and the investment check that you want to deposit and then click the „OK“ button.

How to Deposit Personal Cash in QuickBooks

You can also check this link to learn more aboutdifferent types of owner’s equity. Partner distribution means you are moving last year’s retained earnings to each partner’s equity account. On the other hand, Owner Draw is an equity-type account used when you take funds and put money in the business.

Type your own name or the name of the co-owner who is making the investment in the „Detail“ area. On the second line, selectPartner’s equityorOwner’s equity. You’ve got me if you have an additional concern about QuickBooks.

If you’re in need of one, there’s an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business’s success. I appreciate you for joining the thread, @accountingatheart.

- It excludes the owner’s withdrawal amounts from the business.

- Learn how to set up owners equity account in QuickBooks.

- If you’re the sole owner, you need to set up just one equity account.

- There are some differences between the products, so it’s best to make sure you’re working with the correct team.

I know a lot of tax preparers report this as a shareholder loan to the corporation. However, with these small S Corps there never is a loan agreement and no interest is charged. First of all, Click the Import available on the Home Screen. For selecting the file, click on „select your file,“ Alternatively, you can also click „Browse file“ to browse and choose the desired file. You can also click on the „View sample file“ to go to the Dancing Numbers sample file.

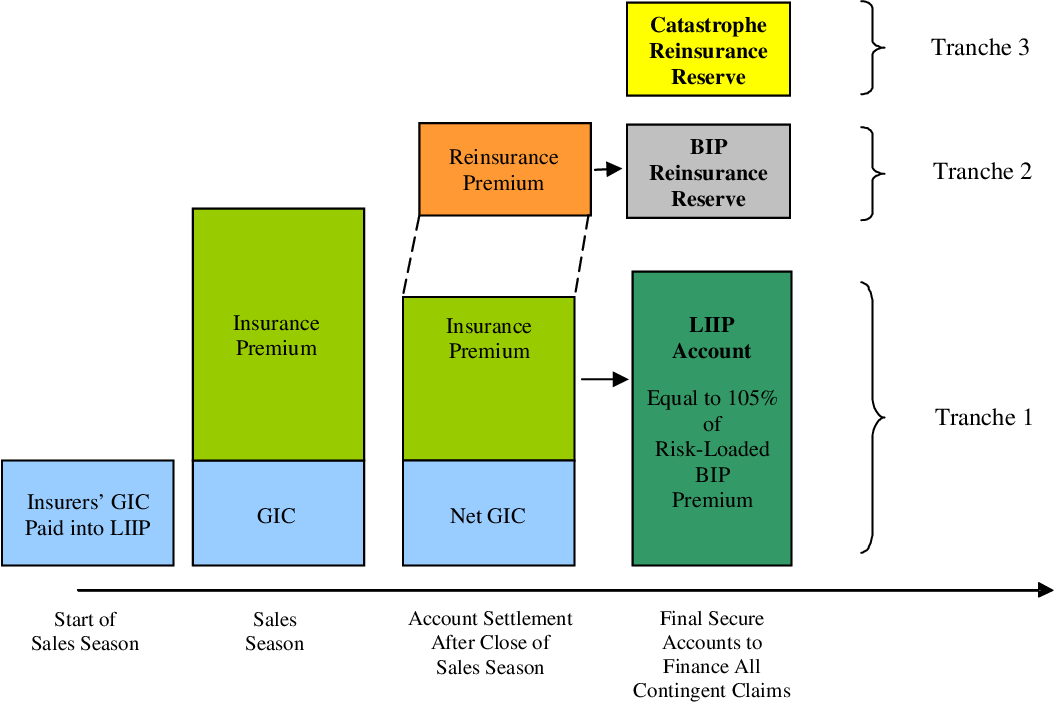

Owners Contributions

If the company is a partnership, LLC or single member LLC or sole prop then this is an owner contribution in the equity section. If the company is an S or C-Corp, the answer would depend on whether the owner expects to be paid back. If to be paid back, then this would show as a liability called Shareholder/Stockholder loan. If not to be paid back, then it would be an account called Additional Paid in Capital which is an equity account. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments.

In QB Desktop Pro 2019, when creating a new account for the purpose of owner contributions, I do not see a Detail Type field referenced in step5. Once you complete the setup steps, your equity calculations and record keeping will become easy and very less time consuming. At the time of setup of New Customers or Vendors, the opening balance is recorded.

In the statement of retained earnings funds to this deposit section, enter the name of the investor in the Received from field. In the reference field of the expense or bill, enter something like “Internal” to help you easily identify this transaction later. Select an account to categorize what the owner bought for the business. Click the „Save and Close“ button to record the transaction and exit the window. You have clicked a link to a site outside of the QuickBooks or ProFile Communities.

What are the Benefits of Recording Owner Investment in QuickBooks?

Click the „From“ account drop-down menu button and then select the applicable owner equity account from the list of available accounts. Owner’s equity is the amount that represents the owner’s investment in the business. It excludes the owner’s withdrawal amounts from the business.

The ending statement of the bank balance transaction of a new bank account. As stated already, shareholder can take distributions without tax consequences as long as they don’t exceed his basis. In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. Our professionals are here to help you with recording owner’s capital in QuickBooks with ease.

Account Reconciliation Software Market Technological Advancement and Growth Analysis 2023 – 2030 QuickBooks, – EIN News

Account Reconciliation Software Market Technological Advancement and Growth Analysis 2023 – 2030 QuickBooks,.

Posted: Tue, 11 Apr 2023 13:35:00 GMT [source]

Worried about losing time with an error prone software? Our error free add-on enables you to focus on your work and boost productivity. Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work. Enter the expenses the same way as above, substituting the Shareholder Contributions account instead of the Owner’s Equity account.

Once done, I’m confident you’ll be able to record the owner’s contribution into your account. In addition, I’ve also included our detailed guide in creating your new equity account. For banking and other purposes he would like this additional amount to be shown in the equity section of the balance sheet. After that, apply the filters, select the fields, and then do the export.

All you need to do is create an equity account and then you add the cash provided to the particular equity account. In simple terms, the owner’s capital comprises the profits, investment, Retained Earnings, and other additional funds that are related to the owner of the company. Once you’ve set up your owner or partner as a vendor, you’ll need to set up their owner or partner equity account. These accounts let you see what someone invests in and draws from a business.

Schreibe einen Kommentar